January 23, 2026

Week in Review

The week’s essential market and economic updates.

Subscribe to the Point of View

Sign upBy clicking Sign Up, you’re confirming that you agree with our Terms and Conditions.

Breakeven Breakout

Week Ending January 23, 2026

Breakeven Breakout

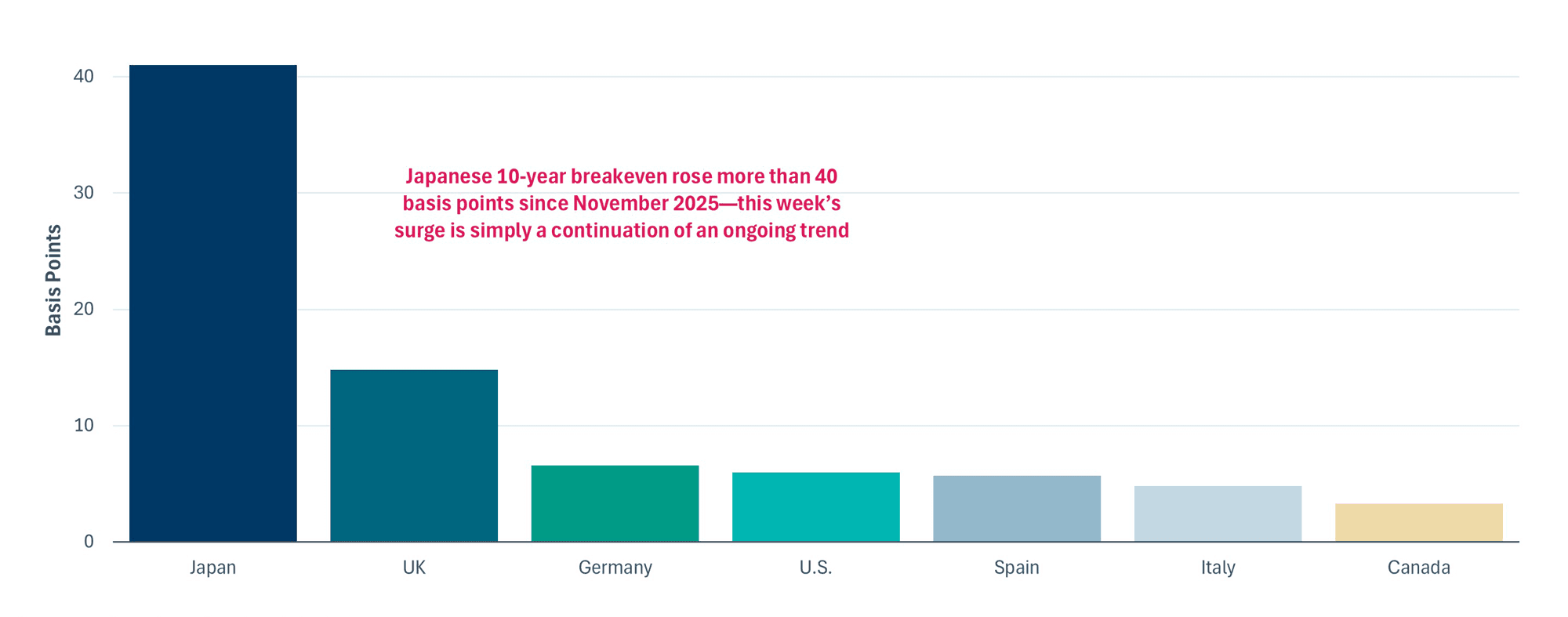

10-Week Change In 10-Year Breakevens* In G7 Countries

Sources: Bloomberg, Payden Calculations

*10-year breakeven equals nominal 10-year government bond yield minus 10-year inflation-indexed bond yield

This week, global bond market volatility returned. Despite the headlines, the driver was not the U.S. but news from Japan. The Japanese 30-year bond yield surged nearly 40 basis points in a single week and is now higher than Germany’s. Investors point to Japanese Prime Minister Takaichi’s pitch to cut taxes as the main reason fueling the surge in yields. But there’s more to the story. First, the jump this week was a continuation of an ongoing trend—the Japanese 30-year bond yield has been rising steadily, with a cumulative increase of 300 basis points since 2022. Second, most of the rise in Japanese yields was driven by 10-year inflation breakeven, which is the (annualized) additional return investors require to compensate for anticipated inflation over the next 10 years. It turns out that over the last 10 weeks, Japan’s 10-year breakeven rate increased by 40 basis points, seven times the average rise across other G7 countries. Third, the rise in Japanese breakevens makes sense given that the nation’s core inflation has remained around 1.6% for over two years, a trend the country has not seen since the late 1990s. So, the rise in breakevens and bond yields may reflect a normalization rather than another bond market crisis.

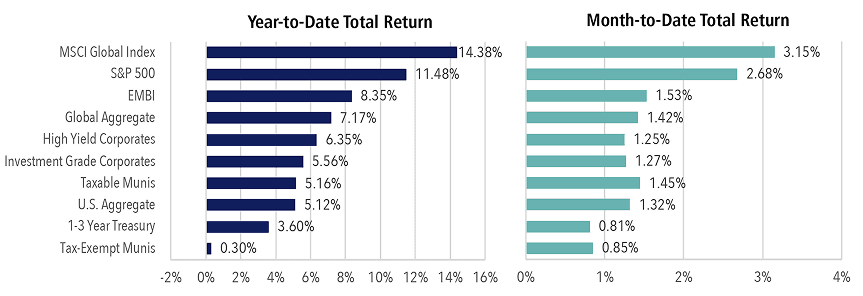

Total Returns by Asset Class

Source: Bloomberg

Highlights of the Week

High Yield: The new issue market is very active this week as issuers capitalize on historically tight spread levels to issue at favorable coupon rates. While investors might be disappointed by these tight spreads, they don’t necessarily result in poor returns. In fact, spreads reached their post-GFC lows a year ago today, and since then, the asset class has delivered a solid 8.1% return. In this environment, patient investors can be rewarded.

Corporates: Volatility has recently impacted markets, slowing issuance after $145 billion was priced during the first two weeks of the year. So far this month, we have seen $170 billion in issuance. Despite volatility, corporate spreads have tightened, with the option-adjusted spread down 7 basis points (bps) year-to-date to +71 bps.

Municipals: According to LSEG Lipper, Municipal fund inflows remained positive for the ninth consecutive week, totaling just under $1 billion. January 2026 has started strongly, with total municipal bond fund inflows reaching $4.3 billion year to date.

Equities: U.S. equities finished the week modestly lower amid geopolitical headlines. Sector performance was mixed, with energy, materials, and consumer staples leading while utilities, financials, and real estate lagged.

Securitized Products: Markets extended their strong start to the year, with European collateralized loan obligation (CLO) primary deals tightening across the board. AAA spreads dropped below +125 basis points despite heavy supply expected in the first quarter. Demand remains strong in both primary and secondary markets, leading to spread compression, profit-taking in AAA, and selective exits from weaker mezzanine tranches. Loans are also priced aggressively, although softer index performance and renewed tariff-related volatility slightly subdued the bullish tone.

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Normal Text Bold Italic 1 2

Block quote

Table Head | Table Head |

|---|---|

Table body | Table body |

Payden's expert insights delivered to your inbox

Sign up for updates, including the Week in Review and Payden & Rygel Point of View.

By clicking Sign Up, you're confirming that you agree with our Terms and Conditions.