Balanced Strategies

U.S. Balanced Objective

What It Is, Why It Works, and Why It’s Different

Payden & Rygel’s U.S. Balanced Strategy helps investors pursue long-term growth and capital preservation through a diversified allocation to U.S. stocks, bonds, and cash. Designed for clients seeking a more measured approach to wealth accumulation, the strategy blends rigorous economic analysis with disciplined portfolio construction to navigate market cycles.

Unlike rigid 60/40 portfolios, our approach is highly adaptable. We tailor allocations to client objectives, using a mix of fundamental research, valuation insights, technical trends, and common sense. The result: an efficient multi-asset strategy that strives to smooth volatility and deliver consistent returns over time.

How Payden’s Balanced Strategy Fits into the Broader Definition

Below, we break down how our approach helps clients meet key financial goals:

Strategic Asset Allocation

A blend of equities, fixed income, and cash calibrated to client return/risk preferences. Asset classes are selected for both return potential and complementary behavior.

Fundamental and Quantitative Discipline

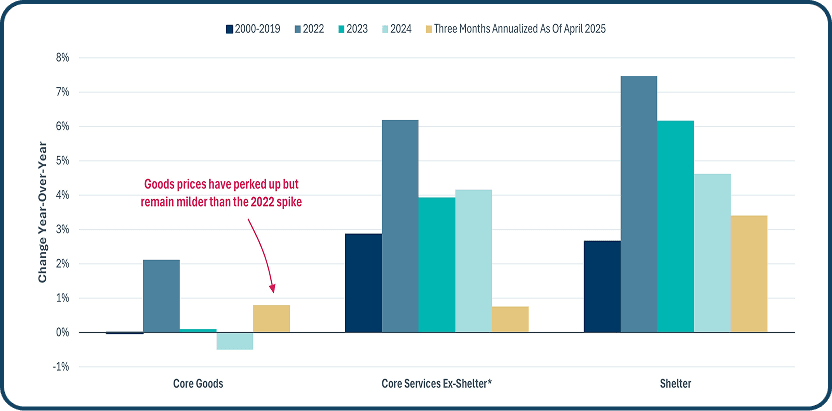

Equity and bond selections are informed by deep macroeconomic analysis, valuation models, asset flows, and technical factors, blending art and science in decision-making.

Active Rebalancing & Tactical Adjustments

While grounded in strategic allocation, we tactically adjust based on shifting conditions. This includes over/under-weighting sectors or asset classes based on opportunity and risk.

Diversification Across Market Conditions

Our multi-asset design helps manage drawdowns and smooth performance. We emphasize true diversification by combining assets with low correlation and complementary return profiles.

Tailored Mandates

Mandates can be structured for absolute return or relative return objectives, depending on the investor’s goals. Customization is key, from benchmark selection to portfolio tilt.

Global Balanced

A Global Perspective on Multi-Asset Investing

Payden & Rygel’s Global Balanced Strategy expands the balanced framework across borders. With access to international equities, sovereign and corporate debt, and global cash equivalents, this strategy is designed to help investors meet long-term goals while managing currency, regional, and geopolitical risks.

Strategic allocation is informed by country-specific macro research and correlation analysis, while futures may be used to tactically adjust exposure

It’s a globally aware, risk-conscious approach for clients seeking broader diversification with purpose.

Related Insights

Curated perspectives selected to inform, prompt reflection, and broaden thinking.

Explore more of our strategies

Fixed Income Strategies

Fixed income strategies focused on global bond markets, supported by research-driven analysis and active risk management.

Equity Income Strategy

An equity strategy designed for risk-focused investors seeking income and long-term price appreciation.

Discover what’s possible

Unlock new opportunities with bold ideas, thoughtful guidance, and a vision tailored to you. One of our advisors will be in touch to discuss the way forward.

Investment in foreign securities entails certain risks from investing in domestic securities, including changes in exchange rates, political changes, differences in reporting standards, and, for emerging market securities, higher volatility. Investing in high-yield securities entails certain risks from investing in investment grade securities, including higher volatility, greater credit risk, and the issues’ more speculative nature. The value of fixed income portfolios will rise and fall due to changes in interest rates and other economic factors. Investment portfolios could lose principal.